Warnings: math and spreadsheets.

The first day of Spring is Tax Day for the residents of Oceanside. Taxes help pay for community lots and lead to the opening of other districts including the business, university, military, and vacation districts. I explain a bit about taxes on my Finance page, but I wanted to go into more detail in a separate post.

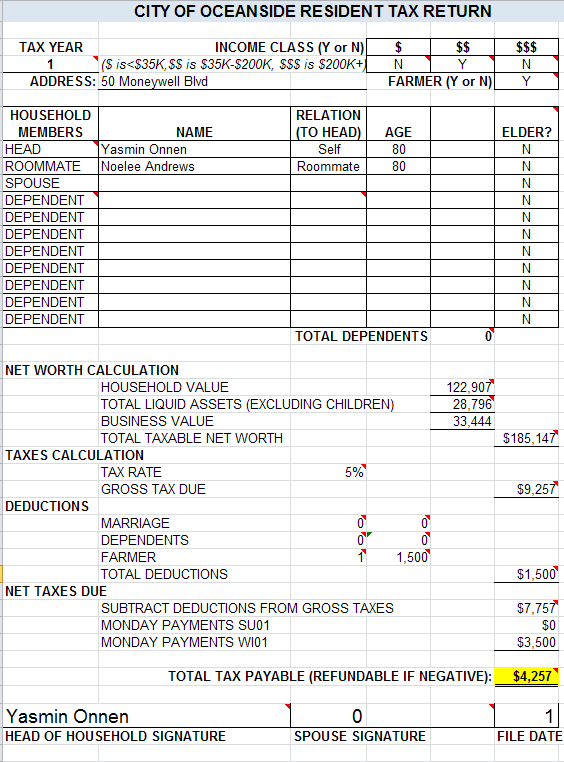

The Tax Return Sheet Breakdown

The Tax Return Sheet I am using is Laurel Crossing’s Tax Collecting spreadsheet. I made small changes to accommodate my playing style. It was a godsend when I was figuring out how to make the taxes make sense. I started using this method because basically my sims have way too much money. I have not been diligent about writing down how much they have in loans and repaying those loans. This way will level the playing field. The tax sheet also allows the sims to receive refunds and get tax breaks for marriages, children, and living on a farm, and to be taxed by how much money they have. Let’s break down the tax sheet.

The top part lets you input the tax year, lot address, and whether the household is considered a farm or not.

Income Class is calculated by how much the total taxable net worth is (more on that below).

- Households that have less than §35,000 are taxed 5% of their net worth. These are low income households. I currently do not have any low income households.

- Households that have between §35,000-§200,000 are also taxed 5% of their net worth (this may change if I actually have low income households). These are middle income households. I have ten middle income households.

- Households that exceed §200,000 are taxed 10% of their net worth. These are high income households. I have one high income household.

I define a farm as a lot that has numerous crops growing on it for profit. Right now I have three farms: the Goodacres, the Lambswool’s nectary, and the Onnen-Andrews farm which you haven’t seen yet.

The next part lists the head of household, spouses, and dependents. The total dependents will be added to the sim’s deductions. The spouse will be added to the marriage deduction. For age I use Days. Elders living in the house who are not head of household or a spouse are considered dependents. I have also created a sheet for roommates. Roommates do not count as a spouse nor a dependent so no marriage credit is given.

The Net Worth Calculation is broken down by household value, total liquid assets, and business value.

Household Value is the total wealth of a household. This is found on the neighborhood screen after clicking on that household.

Total Liquid Assets is the total amount the household has to spend.

Business Value is the total the business or businesses are worth. This is the value shown on the neighborhood screen after clicking on the lot.

*Note that I’m using the Landgraabs as an example but they are exempt from taxes because Vivian Landgraab is the Treasurer.

From here you will get your total taxable net worth. The spreadsheet takes the amount and cross-references it with the tax bracket the household is in — low, middle, or high income — and sets the percentage of the tax rate which gives the gross tax due.

Deductions! Now you can see if you get any of your simoleons back. Married sims receive a §1500 tax credit. Sims will receive a total of §1000 per dependent. Farms receive a §1500 tax credit. This total will be subtracted from the gross tax due.

The last part calculates the net taxes that are due or how much of a refund is owed. Here the spread sheet subtracts the gross tax due from the deductions. The next two lines are the deductions of the taxes already paid each Monday. The total tax payable is what each household owes. If the number is negative then that amount is what the Treasurer needs to refund to the household.

Are you still awake? Good! Let’s see how much each taxable household needs to pay in Year 02!

The Barrett/Brook Household

Paragon Barrett is the head of household considering he is the one that rents the condo from the Lambswools. Achilles Brook is just his roommate but he still has to file. Their combined salaries put them into the medium tax bracket so they will pay 5% of their net worth. Even though Achilles has a child he cannot claim him on the tax return since Hiro is in the custody of his ex Minka Yomoshoto. The only business that is taxable is Baked bakery. Achilles’ lab is not technically taxable because the Business District is not open. They have no deductions so the 5% of their combined taxable net worth, §155992, is §7800. They only have one weekly tax payment (because they were not residents in Summer 01) of §2749. They owe a total of §5051 in taxes.

Paragon Barrett is the head of household considering he is the one that rents the condo from the Lambswools. Achilles Brook is just his roommate but he still has to file. Their combined salaries put them into the medium tax bracket so they will pay 5% of their net worth. Even though Achilles has a child he cannot claim him on the tax return since Hiro is in the custody of his ex Minka Yomoshoto. The only business that is taxable is Baked bakery. Achilles’ lab is not technically taxable because the Business District is not open. They have no deductions so the 5% of their combined taxable net worth, §155992, is §7800. They only have one weekly tax payment (because they were not residents in Summer 01) of §2749. They owe a total of §5051 in taxes.

The Biltmore Household

The Biltmores are in the middle income tax bracket. Sadie owns the house so she is the head of household. The Biltmores have six children (yikes) and are married so their deductions total a whopping §7500! The only taxable business they own is Fitz’s Biltmore Construction Company. The Oceanside Fire Station and the Oceanside Police Station are government buildings and therefore are not taxed. The 5% of their net worth is §5995. Minus their deductions and their weekly tax payments, the Biltmores are due a refund of §3077!

The Firestone Household

The Firestones are married and have four children so their deductions are §5500. Their taxable business is Oceanside Customs. The school buildings that Selena owns are government buildings and are not taxed. They owe §2941 in taxes which will hurt them since they only have §3485 on hand.

The Goodacre Household

Our first farm! The Goodacres are also the only taxable residents that fall into the high income tax bracket which means they need to pay 10% of their net worth instead of 5%. The Goodacres are married and have five children. The farm gives them an extra §1500 of deductions putting their total deductions at §8000. They own one taxable business, Goodacre’s Grocery Store. The Church, Our Gray Lady of Plumbobs, is tax free. Even with all of their deductions and weekly tax payments the Goodacres still owe the most: §13,024. Maybe that’s what Owen is always crying about…

The Kotsomiti Household

Rocky Kotsomiti is all by his lonesome but his swanky bachelor pad is worth a pretty penny. He has no business, no deductions, and only one weekly payment (because he wasn’t a resident during the Summer). Rocky will have to do some hustling in order to pay the hefty tax of §5111 since he only has §3668 on hand.

The Lambswool Household

The Lambswool’s nectary helps up their deductions — married, five kids — to §8000! And boy do they need it! Their taxable business is the seafood restaurant, The Crimson Crab. The Lambwools will receive a modest refund of §2456.

The Mason-Troubadour Household

Even though Kendrick and Brodie are mad about each other they are not married so they will miss out on the §1500 tax credit. Maybe this will be a kick in the butt for them to get hitched! (I won’t hold my breath…) Their three children give them a §3000 deduction. Their taxable business is The Troubadour Cafe. The Oceanside Post Office is a government building and Brodie’s Primp salon is technically not open until Spring. Their taxes owed are still pretty decent, just §1174.

The Moulden Household

Abbot’s junky little home (which you haven’t seen yet) is worth more than the Lambswool’s farm! Anyways… Abbot is a bachelor with no dependents so he has no deductions. His total owed is §4456. Better start selling all of those metal scraps.

The Onnen-Andrews Household

Yasmin and Noelee now live on a lovely farm (which you haven’t seen yet) which earns them the farm deduction. Even though they are very much in love they are not married and have no children (but maybe that will change… *crosses fingers*). Their taxable business is Noelee’s second-hand store, Second Life. Yasmin owns the Onnen Natural History Museum but it does not count since the Business District is not unlocked. Their taxes due are §4257.

The Troubadour-Healey Household

Another unmarried couple but they have kids! Those four little buggers give them §4000 in deductions. Again, since Matisse has custody of Cyan her father Diego cannot claim her on his taxes. Their taxable business is Kent’s Healey Potter. Because of their generous payments on the weekly tax days Matisse and Kent are due a refund of §1399.

The Yomoshoto Household

Miss Minka is lucky she married her true love Diego in more ways than one — she gets a §1500 deduction! Even though she currently doesn’t have possession of her two children she can still claim them which gives her a §2000 deduction. Their taxable business is Diego’s Dance Academy. With their combined weekly payments and their deductions they will receive a small refund of §845.

And that’s it! Easy peasy right? I uploaded the completed spreadsheets here [SFS] [Mediafire] if you want to play around with them and see how they work for your hood. All credit goes to Laurel Crossing.

Thanks for reading!! ^.^

No Comments